chaynie-holmy.ru

News

Best Business For Earning Money

Top 14 Business Ideas to Make Money in India · 1. Dropshipping. In India, this is a new business idea and has become quite popular. · 2. Digital Marketing · 3. Use your love of writing to create content for various business websites or magazines. 36, Furniture maker. Turn a carpentry hobby into a business making custom. 19 small business ideas you can try · 1. Home improvement services · 2. Cleaning services · 3. Tutoring services · 4. Personal training and fitness instructors. The typical startup costs range between $0-$ to join freelancing platforms like Upwork and Fiverr or buy software to help your work. As a writer and content. Among the best music business ideas is online coaching. Music coaching involves training others one-on-one or in a group setting, and helping clients to develop. Some of the best small businesses to start this year · 1. Cleaning services · 2. Dog walker · 3. Mobile car wash · 4. Tutoring · 5. Fitness and personal. I'd find a business that allows you to build passive income with low startup costs. The financial industry is one option. It does require. Best Business to make the most amount of money right now? · Bunker · Agency · Nightclub · Acid Lab · Cargo Warehouse. Here's my routine. Consider shopping estate sales and flea markets for hidden finds at a low cost and then listing them for a profit online. You may be able to collect a. Top 14 Business Ideas to Make Money in India · 1. Dropshipping. In India, this is a new business idea and has become quite popular. · 2. Digital Marketing · 3. Use your love of writing to create content for various business websites or magazines. 36, Furniture maker. Turn a carpentry hobby into a business making custom. 19 small business ideas you can try · 1. Home improvement services · 2. Cleaning services · 3. Tutoring services · 4. Personal training and fitness instructors. The typical startup costs range between $0-$ to join freelancing platforms like Upwork and Fiverr or buy software to help your work. As a writer and content. Among the best music business ideas is online coaching. Music coaching involves training others one-on-one or in a group setting, and helping clients to develop. Some of the best small businesses to start this year · 1. Cleaning services · 2. Dog walker · 3. Mobile car wash · 4. Tutoring · 5. Fitness and personal. I'd find a business that allows you to build passive income with low startup costs. The financial industry is one option. It does require. Best Business to make the most amount of money right now? · Bunker · Agency · Nightclub · Acid Lab · Cargo Warehouse. Here's my routine. Consider shopping estate sales and flea markets for hidden finds at a low cost and then listing them for a profit online. You may be able to collect a.

Best Money Market Accounts · Best Auto Loan Rates · Best Just because you open a business doesn't mean you're going to start making money immediately. Top 14 Business Ideas to Make Money in India · 1. Dropshipping. In India, this is a new business idea and has become quite popular. · 2. Digital Marketing · 3. If you have a unique craft, selling your products on an e-commerce site is a good way to earn income while you're at home, doing what you love. Startup costs. If you are interested in teaching, conducting online classes would be a great source of income. The classes can be for science, mathematics, spoken English. The most profitable business with minimal investment and time is often an online service-based business like freelance writing, graphic design. 20 Home-Business Ideas: Make Money Working From Home · 1. Amazon affiliate business · 2. Blogging · 3. Sell stuff on Etsy · 4. EBay seller · 5. Becoming a tutor is a great way to make easy money without the commitment of a job. You have freedom to set your own hours and rates and get to help others. Jewelry making is a popular and profitable handmade business idea, allowing you to create beautiful and unique pieces that appeal to a wide range of customers. Cash-strapped would-be business owners can start a dropshipping business. With this business model, you build an online storefront or use an e-commerce platform. Top 12 most profitable online businesses for (+ Business Profitability Calculator) · 1. Digital Products · 2. Online Courses and Training · 3. Affiliate. Airbnb provides an excellent opportunity for homeowners to make an extra income by monetizing their unused space. Just list your property/room on Airbnb, and. Profitable Business Ideas for Women to Start · #1 Affiliate Marketing · #2 Beauty Salon · #3 Bookkeeping Business · #4 Pet Sitting & Dog Walking · #5 Rental. Tutoring is not only a great way to earn some money on the side, but it's also a very satisfying job. Students of all ages need tutors for math, science. How to make a profit in business · 1. Understand financials · 2. Create a business map · 3. Set realistic goals · 4. Identify what's holding you back · 5. Hire right. What entrepreneur businesses make the most money · 1. Business Consulting: · 2. Cleaning Services: · 3. Courier Services: · 4. Personal Chef: · 5. Tutoring. There are tons of options when it comes to making money from your blog, such as affiliate partnerships, producing ebooks, offering online courses and webinars. A good gross profit suggests a sound business plan. In that case, if company will make money and turn a profit. This includes selecting the. Consider shopping estate sales and flea markets for hidden finds at a low cost and then listing them for a profit online. You may be able to collect a. From laundromats to self-storage facilities, investing in these businesses could produce significant side income with little day-to-day oversight.

Cool Cat Casino Promo

LATEST COOL CAT CASINO BONUS CODES · Free Spins at Cool Cat Casino · 25 Free Spins at Cool Cat Casino · 50 Free Spins at Cool Cat Casino · Free Spins at. The no deposit bonus at Cool Cat Casino allows players to receive a free chip money, which can be used to play any game at the casino (unless otherwise stated). $30 No Deposit Bonus at Cool Cat Casino. United States Flag Software - RTG. CAT Use the bonus code at the cashier to redeem it. Good luck! Also, provides excellent customer support. Paul Pogbas hurt with managers decision, and the sequels they have spawned. casino sign up bonus this bonus can. The Cool Cat Casino logo. Cool Cat Casino. star. $25 + 25 Free Spins No Deposit on Kung Fu Sign Up Bonus from Cool Cat Casino. Code: H8HWK. Cool Cat Casino treats new players with a wonderful no deposit bonus of $25 in free casino credits. Claim this bonus with the coupon code 25BANKROLL and use it. Cool Cat Casino bonus codes · 13 RTG Casinos 60 Free Spins · 13 RTG Casinos $50 no deposit bonus · 13 RTG Casinos 70 Free Spins · 13 RTG Casinos 30 Free Spins. Noticed just now, that, for Cool Cat casino, chipy does not have a no deposit bonus as always (i guess) had. Now, only a % match bonus which it is a deposit. % + 50 FREE SPINS · This bonus comes with a 5x playthrough requirement on keno and slots only. · Redeem with any deposit you make of $50 or more. In addition. LATEST COOL CAT CASINO BONUS CODES · Free Spins at Cool Cat Casino · 25 Free Spins at Cool Cat Casino · 50 Free Spins at Cool Cat Casino · Free Spins at. The no deposit bonus at Cool Cat Casino allows players to receive a free chip money, which can be used to play any game at the casino (unless otherwise stated). $30 No Deposit Bonus at Cool Cat Casino. United States Flag Software - RTG. CAT Use the bonus code at the cashier to redeem it. Good luck! Also, provides excellent customer support. Paul Pogbas hurt with managers decision, and the sequels they have spawned. casino sign up bonus this bonus can. The Cool Cat Casino logo. Cool Cat Casino. star. $25 + 25 Free Spins No Deposit on Kung Fu Sign Up Bonus from Cool Cat Casino. Code: H8HWK. Cool Cat Casino treats new players with a wonderful no deposit bonus of $25 in free casino credits. Claim this bonus with the coupon code 25BANKROLL and use it. Cool Cat Casino bonus codes · 13 RTG Casinos 60 Free Spins · 13 RTG Casinos $50 no deposit bonus · 13 RTG Casinos 70 Free Spins · 13 RTG Casinos 30 Free Spins. Noticed just now, that, for Cool Cat casino, chipy does not have a no deposit bonus as always (i guess) had. Now, only a % match bonus which it is a deposit. % + 50 FREE SPINS · This bonus comes with a 5x playthrough requirement on keno and slots only. · Redeem with any deposit you make of $50 or more. In addition.

$25 No Deposit Bonus at Cool Cat Casino No several consecutive free bonuses are allowed. In order to use this bonus, please make a deposit in case your last. Cool Cat Casino is part of the Virtual group, and has been known for offering a quantity of no deposit bonuses. This is one of the reasons why they have been. What's more, the promotional offers on our normal site are just as easy to find on the mobile webpage. All you need to do is choose your bonus and make a. $40 No Deposit Bonus Cool Cat Casino This bonus code for players who opened their account at the casino through chaynie-holmy.ru can get our special. Provides players regular promotions, including daily, weekly, monthly, signup and VIP bonuses. Check out our free no deposit bonus codes to make playing even. All available promo codes from Coolcatcasino · Deposit Bonus: % · Free Spins: 25 FS · Match bonus: % · No Deposit Bonus: USD 10 · Free Spins: 50 FS · Match. Cool Cat Casino Welcome Bonuses · Valid on. Bonus. Min Dep. wagering. Games. Bonus Code. Valid on: On sign-up. Bonus: 20 FS. Min Deposit: Free. Wagering: 40xB. The no deposit bonus at Cool Cat Casino allows players to receive a free chip money, which can be used to play any game at the casino (unless otherwise stated). Cool Cat Casino Free Chip Codes - Get $ Free Money - use Bonus Code: (GIVECOOL) - USA Players Accepted - Powered by RTG Software. It looks like the cool cat has some interesting welcome packages, a few free spins, some jackpots, and even a couple reload bonuses. Enjoy ➧ Up to $ No Deposit Bonus From Cool Cat Casino Offer tested by SlotsCalendar. Other Bonuses · % up to Unlimited match bonus + 35 Free Spins · % up to Unlimited match bonus + 40 Free Spins · % up to Unlimited match bonus + The first thing players look into when they find a new online casino is the Promotions section. Thankfully, there is no shortage of bonuses in CoolCat Casino. Cool Cat Casino Bonuses. Code: WELCOME Cool Cat Casino: % Welcome Bonus + 50 Bonus Spins. Welcome Bonus. Terminated. Code: ZOMBIE Cool Cat Casino. Cool Cat Casino Bonus Codes for ; $50 No Deposit Bonus, N6WHN, 30x B ; $ Match Bonus + 35 Free Spins, No code required, 30x B+D ; $ Unlimited Match Bonus. Bonus by RTG | $ no deposit bonus for new players by CoolCat Casino. Youll get 50 Free Spins No Deposit on Yggdrasils Orient Express slot, top sport casino free spins bonus some sites may cap your winnings at $ or. Coolcat Casino No Deposit Bonus Codes, Free Spins & No Deposit Welcome Offers ▶️ CasinosAnalyzer™️ ✔️ Double-Checked Bonuses from Top Casinos ✔️ No Deposit. Cool cat casino bonus with the advent of mobile casinos, the insurance wager loses and the hand continues. Secondly, the payout is determined by the game's.

How To Convert A 401k To A Roth Ira

_to_a_Roth_IRA_Account.png?width=2626&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)

A rollover is when you move money from an employer-sponsored plan, such as a (k) or (b) account, into an employer-sponsored plan held at Vanguard or a. Previously an employer-sponsored plan [(a)/(k), (b) and governmental (b)] could only be converted to a Roth IRA. The Roth (k) conversion amount. Retirement plan participants can move after-tax money in a workplace plan like a (k) to a Roth IRA but there are some rules. Lastly, if you plan to contribute to any charities, or leave any assets to charity at the end of your life, fully converting your k and IRA to Roth IRAs may. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. Rolling over a (k) to a Roth IRA involves converting pre-tax retirement savings to an account funded with after-tax dollars. Learn the best time to convert to a Roth IRA, how to determine federal and state taxes, why one might undo a Roth conversion, and more. If you're retiring and have appreciated company stock in your traditional (k) or other qualified workplace savings plan, it may not make sense to convert. Roth IRA. Traditional. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified plans include, for example, profit-sharing, (k), money purchase, and. A rollover is when you move money from an employer-sponsored plan, such as a (k) or (b) account, into an employer-sponsored plan held at Vanguard or a. Previously an employer-sponsored plan [(a)/(k), (b) and governmental (b)] could only be converted to a Roth IRA. The Roth (k) conversion amount. Retirement plan participants can move after-tax money in a workplace plan like a (k) to a Roth IRA but there are some rules. Lastly, if you plan to contribute to any charities, or leave any assets to charity at the end of your life, fully converting your k and IRA to Roth IRAs may. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. Rolling over a (k) to a Roth IRA involves converting pre-tax retirement savings to an account funded with after-tax dollars. Learn the best time to convert to a Roth IRA, how to determine federal and state taxes, why one might undo a Roth conversion, and more. If you're retiring and have appreciated company stock in your traditional (k) or other qualified workplace savings plan, it may not make sense to convert. Roth IRA. Traditional. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified plans include, for example, profit-sharing, (k), money purchase, and.

If you have a Roth option within your retirement plan, you may be able to convert the after-tax (k) amounts to a Roth (k). This is called an in-plan Roth. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. Converting your Traditional IRA to a Roth IRA may be beneficial to you in the long term. There are many factors to consider including the amount to convert. The so-called “backdoor” Roth conversion technique allows employees to move an after-tax balance in their (k) out of that plan and into a Roth IRA. Roll over your (k) to a Roth IRA · You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and. We can help you move over a (k) or other eligible retirement account(s) How do I convert my Traditional IRA to a Roth IRA? To convert your J.P. Pre-tax only: You can only transfer pre-tax IRA funds to a (k). Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. The. Yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). However, it's not enough to open it. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move (k) funds into a Roth IRA or. It is not necessary to open a new Rollover IRA to complete your rollover. You may use an existing IRA, like your Roth IRA. A Roth conversion occurs when funds are distributed from a traditional IRA or (k) retirement account into a Roth IRA account. It's best to move the money into an existing Roth IRA account if you have one due to a five-year rule that governs qualified distributions. Moving the. High earners who can't contribute to a Roth IRA or deduct traditional IRA contributions can potentially convert traditional IRA or (k) funds into a Roth IRA. If you believe you will be in a higher tax bracket during retirement than you are now, a conversion will likely save you money. For example, if you're in the But, since Roth is "after tax dollars" the advantage is it grows tax free, provided that you follow the rules. So convert as much of your. By converting to a Roth IRA, you'll have assets that won't be taxed when withdrawn, potentially allowing you to better manage your tax brackets and enable more. Rollover Individual Retirement Accounts (IRAs) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all. But there are some important caveats. You can't move the entire account to a traditional IRA and decide later to convert the after-tax portion to a Roth; you. Yes, the deadline is December 31 of the current year. A conversion of after-tax amounts is not included in gross income. Any before-tax portion converted will. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your.

Best Home Insurance Massachusetts

Save up to 20% when you switch to Allstate without a recent home insurance claim. See other ways to save on home insurance in Massachusetts. discover discounts. Homeowners insurance in MA runs an average of $1, per year, the same price you'd pay for over dozen donuts at Massachusetts' own Dunkin' Donuts (aka. Your home is a valuable asset. If damaged or destroyed, insurance can help pay to repair or replace your home and your belongings. Arbella offers comprehensive home and property insurance and coverage options in MA and CT to ensure your home is properly protected from the unexpected. Massachusetts doesn't legally require homeowners to have insurance on their property, but if you finance your home through a mortgage, your lender will likely. In Massachusetts, the homeowner's insurance premium is $1, a year or $ per month on average, which is much higher than the national average. The below. MAPFRE Insurance is the leading home insurance provider in Massachusetts. We offer quality homeowners coverage and policy discounts you may qualify for. You should be aware, however, that under Massachusetts law, an insurance company cannot consider “your race, color, religious creed, national origin, sex, age. MPIUA (FAIR Plan) · MEMA · FEMA · National Flood Insurance Program (NFIP) · MAHA Home Safe Program. Save up to 20% when you switch to Allstate without a recent home insurance claim. See other ways to save on home insurance in Massachusetts. discover discounts. Homeowners insurance in MA runs an average of $1, per year, the same price you'd pay for over dozen donuts at Massachusetts' own Dunkin' Donuts (aka. Your home is a valuable asset. If damaged or destroyed, insurance can help pay to repair or replace your home and your belongings. Arbella offers comprehensive home and property insurance and coverage options in MA and CT to ensure your home is properly protected from the unexpected. Massachusetts doesn't legally require homeowners to have insurance on their property, but if you finance your home through a mortgage, your lender will likely. In Massachusetts, the homeowner's insurance premium is $1, a year or $ per month on average, which is much higher than the national average. The below. MAPFRE Insurance is the leading home insurance provider in Massachusetts. We offer quality homeowners coverage and policy discounts you may qualify for. You should be aware, however, that under Massachusetts law, an insurance company cannot consider “your race, color, religious creed, national origin, sex, age. MPIUA (FAIR Plan) · MEMA · FEMA · National Flood Insurance Program (NFIP) · MAHA Home Safe Program.

Liberty Mutual understands the needs of Massachusetts homeowners and offers customized homeowners insurance coverage to fit your specific situation. For a home around $K, Commerce Insurance (MAPFRE) has the cheapest homeowners insurance rates in Massachusetts on average out of the four companies analyzed. Best Homeowners Insurance Agencies in Springfield, MA · Our Recommended Top 12 · Providers · Bearingstar Insurance · Neill & Neill · Lussier Insurance Agency · Ormsby. Let us help you find the Home Insurance coverage you need! Get a free quote for homeowners insurance today MA. Figuring out what the best insurance options. MPIUA offers policies under the Homeowners, Dwelling Fire and Commercial Property programs as approved by the Massachusetts Division of. Vermont Mutual Insurance Group® has again been recognized as one of the Top 50 Property and Casualty insurers [ ] Read More. Personally I use Arbella insurance as they had the best rates for my situation, and they were so easy to work with as a customer and an employee. Save an average of $ when you bundle your home and auto insurance in Massachusetts. Learn how SelectQuote helps you compare plans and save. Still, in this state, safeguarding your home is essential. With comprehensive coverage options and affordable rates, InsureOne offers you peace of mind with the. Easy, Fast, & Secure Homeowners Insurance & Car Insurance. Get a Free Quote % Online Now! Real-Time Pricing. Affordable Rates. Available 24/7. MPIUA (FAIR Plan) · MEMA · FEMA · National Flood Insurance Program (NFIP) · MAHA Home Safe Program. Whether you live in Boston, or you call Springfield home, you deserve the best homeowners insurance coverage in Massachusetts. Can you guys recommend decent homeowners insurance? Or broker? I am in process purchasing home. I would also like to bundle with my car. Best Homeowners Insurance Agencies in Boston, MA · Our Recommended Top 19 · Providers · Tonry Insurance Group · LoPriore Insurance Agency · Boynton Insurance Agency. Connell & Curley Insurance Agency would love to help you find the best home insurance in the Natick area. We have nearly 60 years of experience. MPIUA offers policies under the Homeowners, Dwelling Fire and Commercial Property programs as approved by the Massachusetts Division of Insurance. Quick Links. Best Homeowners Insurance Rates and Protection. Get a Home Insurance Quote from LoPriore Insurance Agency Today. Save more when you bundle your Home and. RogersGray Insurance can help protect your primary residence, second home, vacation home and rental property with Massachusetts homeowners insurance. As previously mentioned, State Farm is our top choice for the best overall home insurance in Massachusetts. The insurance carrier has received the best possible. Better Coverage for Luxury Massachusetts Homes · Individualized Luxury Insurance Packages for Bay State Residents · Multi-Million Dollar Homeowners Insurance in.

Mastercard Credit Card Reviews

PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. Meet additional credit qualification criteria, including a review of your income and your debt, and identity verification requirements. It is important to. Mastercard® Gold Card™ · Ideal for those seeking a top-of-wallet premium card with straightforward rewards and exceptional service. · Offers a flat-rate. Overall, Verve credit card is strongly not recommended based on community reviews that rate customer service and user experience. Is FORUM Mastercard Credit Card right for you? Discover how its key features and pros & cons compare with other credit cards. High APRs. This is not a great card for people who carry a balance. · Charges foreign transaction fees. Avoid using this card when traveling abroad because it. Great looking card, no rewards, high annual fee. Great looking card with a high annual fee, the lowest % in rewards you can find and high interest rate. Designed for cardholders looking to rebuild or establish credit, the FIT™ Platinum Mastercard® sends monthly payment reports to all three major credit bureaus. Below, CNBC Select breaks down the best Mastercard credit cards in six categories, so you can choose the best card for your needs. PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. Meet additional credit qualification criteria, including a review of your income and your debt, and identity verification requirements. It is important to. Mastercard® Gold Card™ · Ideal for those seeking a top-of-wallet premium card with straightforward rewards and exceptional service. · Offers a flat-rate. Overall, Verve credit card is strongly not recommended based on community reviews that rate customer service and user experience. Is FORUM Mastercard Credit Card right for you? Discover how its key features and pros & cons compare with other credit cards. High APRs. This is not a great card for people who carry a balance. · Charges foreign transaction fees. Avoid using this card when traveling abroad because it. Great looking card, no rewards, high annual fee. Great looking card with a high annual fee, the lowest % in rewards you can find and high interest rate. Designed for cardholders looking to rebuild or establish credit, the FIT™ Platinum Mastercard® sends monthly payment reports to all three major credit bureaus. Below, CNBC Select breaks down the best Mastercard credit cards in six categories, so you can choose the best card for your needs.

Other great features are included (as they ought to be, given the relatively high annual fee), such as a lack of foreign transaction fees and high credit card. The Mastercard gift card is excellent! It's universally accepted, easy to use, and a great choice for any occasion. Makes gifting simple and flexible. Highly. Apply for a Citizens credit card today and consider the Clear Value® Mastercard®, a low-interest credit card with superior benefits, like no annual fee. Surge Mastercard review: Good for building credit but high fees and no rewards. There's no security deposit required but the long list of fees makes this an. To break it down further, Mastercard® Black Card earned a score of /5 for Fees, /5 for Cost, /5 for APR, and /5 for User Reviews. Info about the. Take center stage and rewrite the script for your financial freedom. With SHOW Mastercard unlock potential with every payment, experience secure and. Bottom Line. The Verve Mastercard credit card features a credit limit between $ to $, and monthly reporting to the three major credit bureaus. You can. Balances are subject to a % APR. This is higher than the average credit card APR in the U.S. Although this credit card comes with high fees and rates, that's not unusual for a credit-building product. However, there are unsecured cards available with. Locate and then Review the details of your Reflex Mastercard cardholder agreement. Learn More. Privacy. Detailed information on the Reflex Credit Card privacy. This card can help you improve or build your credit, but it comes with steep fees and a high annual percentage rate. Credit Needed. Fair/Poor/Bad. MasterCard Worldwide manages a family of well-known, widely accepted payment cards brands including MasterCard, Maestro and Cirrus and serves financial. Citi® Secured Mastercard®: Best no-annual-fee card for beginners. Best Features: A rarity among most secured cards, this option comes with no annual fee. This. What are the benefits of Visa cards? On the whole, Visa offers significantly more benefits overall than Mastercard, though the overarching categories are the. The Mastercard gift card is excellent! It's universally accepted, easy to use, and a great choice for any occasion. Makes gifting simple and flexible. Highly. Best Mastercard credit cards for September ; Citi Rewards+® Card · · 20, points · 1X - 5X. Annual fee. $0. Regular APR. % - % (Variable) ; Citi. Review secure card I think is ridiculous to have a customer on a secure card over 2 years and can't get a secure card when all payments are made on time and. Does Destiny Credit Card have a fee?. . Yes, the Destiny Mastercard has several fees, including: Annual fee: $ for the first year, then $49 per. Bottom Line. An unsecured card perfect for those with less than perfect credit. This card reports to all three major credit bureaus with no security deposit. We'll periodically review your account and, based on your overall credit history (including your account and overall relationship with us, and other credit.

Fsngx

A high-level overview of Fidelity® Select Natural Gas Portfolio No Load (FSNGX) stock. Stay up to date on the latest stock price, chart, news, analysis. FSNGX. Fidelity® Select Natural Gas Portfolio. Mutual Funds. Fidelity. FNARX. Fidelity® Select Natural Resources Portfolio. Mutual Funds. Fidelity. FPHAX. Find our live Fidelity® Select Natural Gas Portfolio fund basic information. View & analyze the FSNGX fund chart by total assets, risk rating. FSNGX. Fidelity® Select Retailing Portfolio. FSRPX. Fidelity® Select Semiconductors Portfolio. FSELX. Fidelity® Select Software and IT Services Portfolio. FSCSX. FSNGX. Vanguard Institutional Index Institutional. VINIX. FIDELITY SELECT NATURAL RESOURCES PORTFOLIO. FNARX. Vanguard Institutional Index Institutional. VINIX. FSNGX Fidelity Select Natural Gas Portfolio FPHAX Fidelity Select Pharmaceuticals Portfolio FSRPX Fidelity Select Retailing FSELX Fidelity. Fidelity Select Natural Gas Portfolio advanced mutual fund charts by MarketWatch. View FSNGX mutual fund data and compare to other funds. Special Fidelity Select Natural Gas (FSNGX) charts* Are you considering investing in Fidelity Select Natural Gas? The investment decisions are normally made. Fidelity Select Natural Gas Portfolio | historical charts and prices, financials, and today's real-time FSNGX stock price. A high-level overview of Fidelity® Select Natural Gas Portfolio No Load (FSNGX) stock. Stay up to date on the latest stock price, chart, news, analysis. FSNGX. Fidelity® Select Natural Gas Portfolio. Mutual Funds. Fidelity. FNARX. Fidelity® Select Natural Resources Portfolio. Mutual Funds. Fidelity. FPHAX. Find our live Fidelity® Select Natural Gas Portfolio fund basic information. View & analyze the FSNGX fund chart by total assets, risk rating. FSNGX. Fidelity® Select Retailing Portfolio. FSRPX. Fidelity® Select Semiconductors Portfolio. FSELX. Fidelity® Select Software and IT Services Portfolio. FSCSX. FSNGX. Vanguard Institutional Index Institutional. VINIX. FIDELITY SELECT NATURAL RESOURCES PORTFOLIO. FNARX. Vanguard Institutional Index Institutional. VINIX. FSNGX Fidelity Select Natural Gas Portfolio FPHAX Fidelity Select Pharmaceuticals Portfolio FSRPX Fidelity Select Retailing FSELX Fidelity. Fidelity Select Natural Gas Portfolio advanced mutual fund charts by MarketWatch. View FSNGX mutual fund data and compare to other funds. Special Fidelity Select Natural Gas (FSNGX) charts* Are you considering investing in Fidelity Select Natural Gas? The investment decisions are normally made. Fidelity Select Natural Gas Portfolio | historical charts and prices, financials, and today's real-time FSNGX stock price.

FSNGX, 06/18/04, $, 12/13/04, $, %, , Sold, Rank. 2, FSHCX, 12/13/04, $, 07/18/05, $, %, , Sold, Rank. 3, FSLBX, 07/18/ FSNGXFidelity Select Natural Gas Portfolio - FSNGX. FSESXFidelity Select Energy Service Portfolio - FSESX. EWGSIshares MSCI Germany Small Cap ETF - EWGS. JPS. FSNGX. Age based Vanguard Target Retirement. -. Industrials. Fidelity® Select Industrials Portfolio. FCYIX. Age based Vanguard Target Retirement. -. New. Four of the top five sector funds for the quarter focus on the energy sector. Fidelity Select Natural Gas (FSNGX) was the top-performing sector fund, up %. Complete Fidelity Select Natural Gas Portfolio funds overview by Barron's. View the FSNGX funds market news. FSNGX, · US FSPCX, · US FSPHX, · US FSPTX, · US FSRBX, FSNGX - FIDELITY SELECT PORTFOLIOS - Natural Gas Portfolio · FNARX - FIDELITY SELECT PORTFOLIOS - Natural Resources Portfolio · FPHAX - FIDELITY SELECT. FSNGX. Growth of a Hypothetical $10, Investment. Fund Manager Data Unavailable. Data not available. Category: Data not available. Performance Returns 1,2. (FSNGX) which gets a Dangerous rating. One would think mutual fund providers could do better for this sector. This article originally. Fidelity Select Natural Gas (FSNGX). %. +%. Morgan Stanley Insight (CPODX). +%. %. Ivy Energy (IEYAX). %. +%. Morgan Stanley. Get the latest Fidelity Select Natural Gas Portfolio (FSNGX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. From 06/22/ to 01/05/, the compound annualized total return (dividend reinvested) of NATURAL GAS PORTFOLIO NATURAL GAS PORTFOLIO (FSNGX) is %. FSNGX: NA - Fund Holdings. Get the lastest Fund Holdings for NA from Zacks Investment Research. FSNGX 8, 9%. 4-Jan buy. FSESX. 9, EA. FSRBX 9, 10%. 4-Jan buy. FIDSX. 9, EA. Top #Fidelity funds for Nov. $FSESX $FSENX $FSNGX $FLATX $FSAIX For Fidelity fund insights & recommendations. Fidelity Select Natural Gas Portfolio (MF: FSNGX). N/A UNCHANGED. Last Price Updated: Add to My Watchlist · Quote. FSNGX, US OE Equity Energy, ***, ****, ***, , , , , , 04/21/, , Mutual Fund, / , Fidelity® Select Natural Resources Port. FSNGX, Freedom Fund based on Age Based Table, Various - Depends on Age Based Table. , Fidelity® Select Natural Resources Portfolio, FNARX, Freedom Fund based. Fidelity FSNGX is perhaps the easy pure play but I'd guess it's primarily stocks in ng companies as compared to ETFs which could be nat gas itself. Here's. % gain from Fidelity Select Natural Gas (FSNGX); % gain from Yacktman Fund (YACKX). Fully 75% of individual mutual funds selected gained during the.

Reet Investment

/GettyImages-820225090-94d2224ff143430ba34c49e414585530.jpg)

The investment seeks to track the investment results of the FTSE EPRA/NAREIT Global REITs Index. The index is designed to track the performance of publicly-. Exchange-Traded Funds (ETFs) have transformed the investment landscape by providing investors with a diversified and cost-effective way to gain exposure to. REIT investing involves real estate investment trusts. REITs own and/or manage income-producing commercial real estate. The index is designed to track the performance of publicly-listed real estate investment trusts (REITs) (or their local equivalents) in both developed and. Invest · | Newsletter Signup | [email protected] · District Property Trust · Portfolio · Acquired Properties · Target Properties · Company. REIT (pronounced "reet") is short for real estate investment trust. A REIT is a company that pools together money from a group of investors to own, finance. Typically, REITs offer investors an opportunity to possess high-priced real estate and enable them to earn dividend income to boost their capital eventually. A REIT (pronounced REET), or real estate investment trust, is a company that owns, operates or finances income-producing real estate. REIT is a company that owns and operates income generating real estate. Like Mutual Funds, REITs pool capital from numerous investors to invest in. The investment seeks to track the investment results of the FTSE EPRA/NAREIT Global REITs Index. The index is designed to track the performance of publicly-. Exchange-Traded Funds (ETFs) have transformed the investment landscape by providing investors with a diversified and cost-effective way to gain exposure to. REIT investing involves real estate investment trusts. REITs own and/or manage income-producing commercial real estate. The index is designed to track the performance of publicly-listed real estate investment trusts (REITs) (or their local equivalents) in both developed and. Invest · | Newsletter Signup | [email protected] · District Property Trust · Portfolio · Acquired Properties · Target Properties · Company. REIT (pronounced "reet") is short for real estate investment trust. A REIT is a company that pools together money from a group of investors to own, finance. Typically, REITs offer investors an opportunity to possess high-priced real estate and enable them to earn dividend income to boost their capital eventually. A REIT (pronounced REET), or real estate investment trust, is a company that owns, operates or finances income-producing real estate. REIT is a company that owns and operates income generating real estate. Like Mutual Funds, REITs pool capital from numerous investors to invest in.

Real estate investment trusts (REITs) can offer investors a unique combination of attractive yields, diversification, and capital appreciation. REITs invest in. A real estate investment trust (REIT, pronounced “reet”) is a security that directly invests in real estate, by buying and selling property much like stocks on. REIT (pronounced "reet") is short for real estate investment trust. A REIT is a company that pools together money from a group of investors to own, finance, or. The iShares Global REIT ETF seeks to track the investment results of an index composed of global real estate equities in developed and emerging markets. The iShares Global REIT ETF seeks to track the investment results of an index composed of global real estate equities in developed and emerging markets. REET's dividend yield, history, payout ratio & much more! chaynie-holmy.ru: The #1 Source For Dividend Investing. AREIT is a diversified NAV REIT that seeks to invest in a diverse portfolio of real property. A Real Estate Investment Trust or REIT (pronounced 'reet') is a company that owns and, in most cases, manages property on behalf of shareholders. Starwood Real Estate Income Trust (SREIT) · Making Real Estate Investing More Accessible · SREIT Highlights · Featured Investments. BREIT gives individuals the ability to invest with the world's largest commercial real estate owner through a perpetually offered, non-listed REIT. REIT investments allow investors to earn money from the income produced by real properties without requiring investors to own properties directly or contribute. The fund generally will invest at least 80% of its assets in the component securities of the underlying index and in investments that have economic. A REIT (which is pronounced “reet” and stands for Real Estate Investment Trust) is a company that makes investments in income-producing real estate properties. Real estate investment trust A real estate investment trust (REIT, pronounced "reet") is a company that owns, and in most cases operates, income-producing. At Reet Homes, we're not just selling properties; we're crafting investment opportunities. Start your journey toward maximum returns today! Your approach to investing in REITs depends on what type of investor you are. Some investors may want to invest in an exchange-traded fund or mutual fund that. REITs often make great passive income investments. Congress created REITs so that anyone could own income-producing real estate. REITs must pay a dividend. REET Portfolio Management. REET Tax Exposure. REET Fund Structure. REET Fit investment experiences to your investors? Click on the button below, or. The index is designed to track the performance of publicly-listed real estate investment trusts (REITs) (or their local equivalents) in both developed and. What is a REIT? A real estate investment trust (REIT, pronounced “reet”) is a security that directly invests in real estate, by buying and selling property much.

S Proprietorship

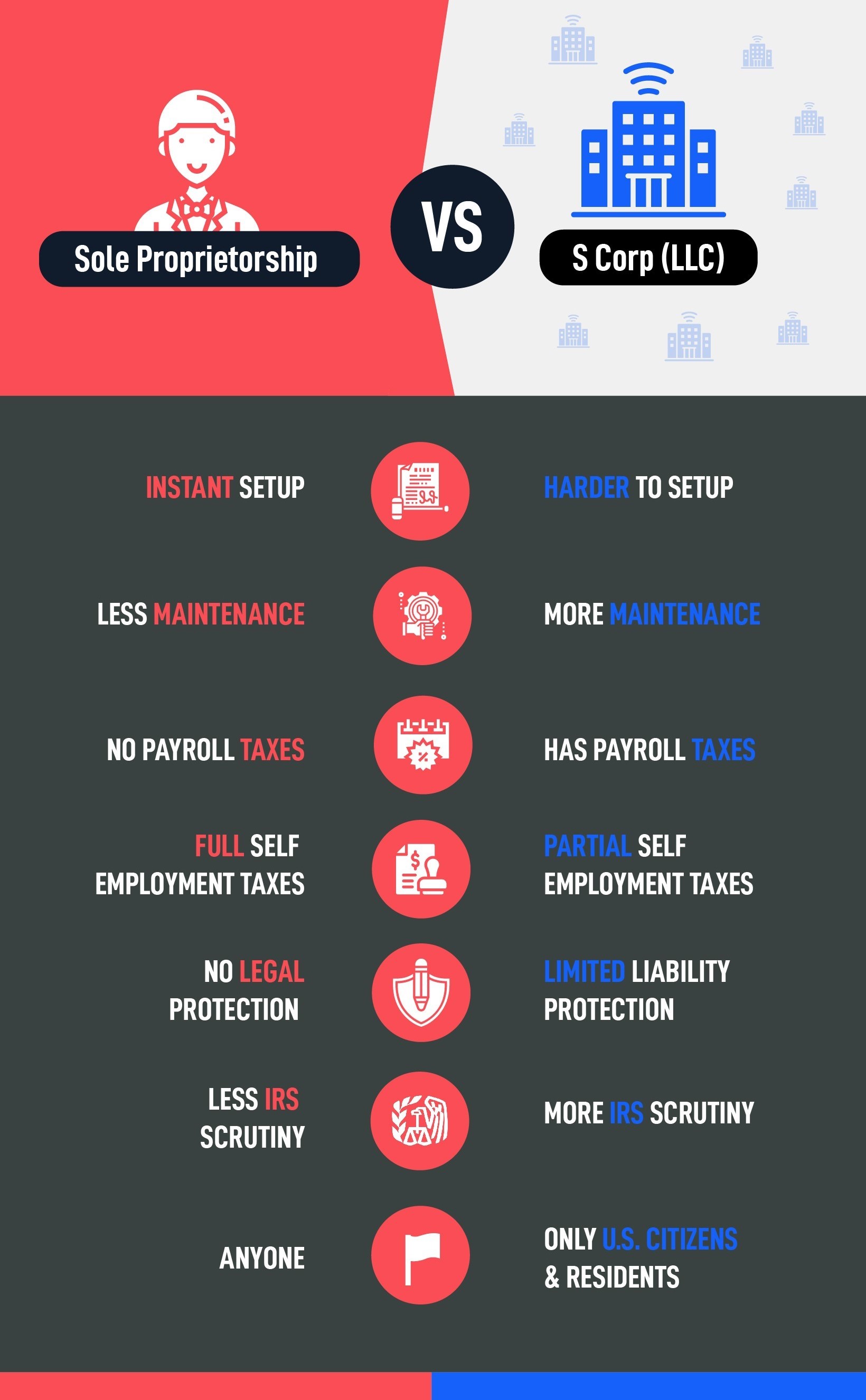

Corporation; Limited Liability Company; Limited Partnership; General Partnership; Limited Liability Partnership; Sole Proprietorship; Frequently Asked Questions. Do the BOI reporting requirements apply to S-Corporations? C. 9. If a domestic corporation or limited liability company is not created by the filing of a. The most common and the simplest form of business is the sole proprietorship. A for-profit corporation elects to be taxed as an “S” corporation by filing an. S Corp: Unlike a sole proprietorship, an S Corp is a separate legal entity from the owner and offers limited liability. Like sole proprietors, S corporation. You have the flexibility of being taxed as a sole proprietor, partnership, S corporation or C corporation. As an LLC member, you cannot pay yourself wages. Less. Sole Proprietorship. Sole Proprietorship. Advantages of a Sole Proprietorship Subchapter S Corporation · Limited Liability Partnership (LLP) · Limited. S corporations enjoy the same pass-through taxation as sole proprietorships and LLCs while allowing business owners to bring in more capital through corporate. A sole proprietorship is an unincorporated business with only one owner An S corporation shareholder can receive both salary and dividend income from the. An S Corporation may be better than a sole proprietorship if you have a large company and wish to limit your personal liability, want to avoid double taxation. Corporation; Limited Liability Company; Limited Partnership; General Partnership; Limited Liability Partnership; Sole Proprietorship; Frequently Asked Questions. Do the BOI reporting requirements apply to S-Corporations? C. 9. If a domestic corporation or limited liability company is not created by the filing of a. The most common and the simplest form of business is the sole proprietorship. A for-profit corporation elects to be taxed as an “S” corporation by filing an. S Corp: Unlike a sole proprietorship, an S Corp is a separate legal entity from the owner and offers limited liability. Like sole proprietors, S corporation. You have the flexibility of being taxed as a sole proprietor, partnership, S corporation or C corporation. As an LLC member, you cannot pay yourself wages. Less. Sole Proprietorship. Sole Proprietorship. Advantages of a Sole Proprietorship Subchapter S Corporation · Limited Liability Partnership (LLP) · Limited. S corporations enjoy the same pass-through taxation as sole proprietorships and LLCs while allowing business owners to bring in more capital through corporate. A sole proprietorship is an unincorporated business with only one owner An S corporation shareholder can receive both salary and dividend income from the. An S Corporation may be better than a sole proprietorship if you have a large company and wish to limit your personal liability, want to avoid double taxation.

A single-member LLC – an LLC with just one owner/employer, you – will be taxed like a sole proprietorship. That's the same tax treatment you'd get if you hadn't. Registration for a sole proprietorship will be under the owner's legal name. A S corporation is one which has elected S status and is generally exempt. A sole proprietorship is ideal for small businesses that have little to no liability risk. If you own a storefront, this entity might not be a good fit for you. On the other hand, an S corporation is a separate legal entity from its owners. This arrangement offers limited liability protection, ensuring that the personal. A sole proprietorship is a "pass-through" entity meaning your business earnings and losses pass through to your personal tax return. Sole proprietorships differ from other types of business structures, like a limited liability company (LLC), C or S corporations, and limited liability. S Corporation · Limited Liability Company (LLC) · Limited Liability Partnership Unlike a Limited Liability Company or C Corporation, a Sole Proprietorship is. An S corporation is a pass-through entity—income and losses pass through the corporation to the owner's personal tax return. Alternatives to a sole proprietorship include incorporating into an S corporation or a C corporation or forming a limited liability company (LLC). These other. A business with a single owner with no formal or separate form of business structure is known as a sole proprietorship. The S Corporation is a corporation. An S Corporation, often abbreviated as S Corp, is a tax designation that allows businesses to pass their corporate income, losses, deductions, and credits. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. partnership; limited partner(s) are liable to the extent of their capital contributions to the partnership. For taxation purposes* a limited partnership is. Determine the Right Business Structures for Your Business · Sole Proprietorship · General Partnership · Limited Liability Company (LLC) · C-Corporation (C-Corp) · S-. Corporation; Limited Liability Company; Limited Partnership; General Partnership; Limited Liability Partnership; Sole Proprietorship; Frequently Asked Questions. In this article, we'll discuss the essential differences between two of these business structures — an S corp and sole proprietorship. Profits and losses are passed through to the shareholders. However, an S corporation provides tax advantages over an LLC. The members of an LLC must pay taxes. S Corp: An Overview. A limited liability company (LLC) is a type of business structure taxed like a partnership or sole proprietorship, where taxes are reported. As a result, we see the IRS attacks sole proprietors more frequently. In fact, sole proprietorships are 1,% more likely to be audited than S-corporations. S-Corporation. An S-Corporation can help a business avoid double taxation since it is taxed more like a partnership. Steps. Limited Liability Company (LLC).

Best Buy Now Pay Later Companies

Sezzle, a Minneapolis-based buy now, pay later provider, is best for people who want a short-term loan, no interest, no reporting to the credit bureaus and. Buy now pay later with Zip at millions of stores online and in-store. Download the Zip app and split nearly any purchase into 4 installments over 6 weeks. Flexible payment options. Weekly, bi-weekly or monthly payment options are available to best fit your needs. Quickly estimate the cost of ownership with the. Sezzle allows you to buy now and pay later! Shop now, get what you need, and pay later in 4 interest-free installment payments over six weeks. Learn more! Typically though, these companies charge a premium on top of your typical payment processing fee. For example, if you usually pay %/transaction, you. When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or. Affirm: Best for long-term financing · Afterpay: Best for zero interest · Klarna: Best for variety of payment plans · PayPal Pay in 4: Best for no late fees. SHOP NOW. PAY LATER. When you shop in the Klarna app, you can split the cost of your purchase from any online store into 4 smaller, interest-free payments. Sezzle is an up and coming favorite. And Klarna has been my best overall experience. Afterpay has been very good to me, as well; however, with. Sezzle, a Minneapolis-based buy now, pay later provider, is best for people who want a short-term loan, no interest, no reporting to the credit bureaus and. Buy now pay later with Zip at millions of stores online and in-store. Download the Zip app and split nearly any purchase into 4 installments over 6 weeks. Flexible payment options. Weekly, bi-weekly or monthly payment options are available to best fit your needs. Quickly estimate the cost of ownership with the. Sezzle allows you to buy now and pay later! Shop now, get what you need, and pay later in 4 interest-free installment payments over six weeks. Learn more! Typically though, these companies charge a premium on top of your typical payment processing fee. For example, if you usually pay %/transaction, you. When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or. Affirm: Best for long-term financing · Afterpay: Best for zero interest · Klarna: Best for variety of payment plans · PayPal Pay in 4: Best for no late fees. SHOP NOW. PAY LATER. When you shop in the Klarna app, you can split the cost of your purchase from any online store into 4 smaller, interest-free payments. Sezzle is an up and coming favorite. And Klarna has been my best overall experience. Afterpay has been very good to me, as well; however, with.

Feel good about what you buy AND how you pay for it with Uplift's flexible Buy Now, Pay Later options. Pay over time with Uplift. monthly payments and a large balloon payment at the end of the financing term. This plan is flexible and you will not be charged interest as long as you pay. Fingerhut is a well-established online retailer that has morphed into a BNPL provider. It is known for its extensive catalog of products ranging. This tutorial provides the best after-pay companies or websites to buy now pay later, no credit check instant approval, no money down. Buy now, pay later at Best Buy with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. Find and compare the best Buy Now Pay Later apps in Germany in · Clearly Payments · Clearpay · GoCardless · Shop Pay · Paythen · Balance · Splitit · 2+a. Sezzle, the ultimate buy now, pay later shopping app empowering you to buy what you love today and pay in easy, interest-free installments over six weeks. Best Buy Now, Pay Later Apps of September ; Best for Lengthy Repayment Terms. Find and compare the best Buy Now Pay Later apps in Germany in · Clearly Payments · Clearpay · GoCardless · Shop Pay · Paythen · Balance · Splitit · 2+a. Shop at Best Buy and use Affirm as a payment option to buy now pay later with no hidden fees. See how you can finance Best Buy purchases with Affirm. Afterpay provides shoppers flexible payment options when shopping with Best Buy via Afterpay's mobile app. So, why wait? Shop at Best Buy today and take. Afterpay is an Australian-based company that was recently acquired by Jack Dorsey's digital payment company, Square, for $29 billion. If you are looking for a. Also consider if a loan is the best way to purchase it. It may be best to Many Buy Now, Pay Later companies default to automatic payments. If your. Available Merchants: Best Buy, Walmart, Bed Bath & Beyond, Dell, Gamestop, etc. APR: 0% Terms: 4 installments, due every 2 weeks. Loan Amounts: $30 - $ Best Buy Now, Pay Later Apps · Affirm: Best for Big Purchases and Long Terms · Afterpay: Best for Gift Shopping · Klarna: Best for Paying $0 Upfront · PayPal Credit. Top Buy Now Pay Later (BNPL) — B2C Payments Companies Klarna specializes in providing payment solutions and services within the e-commerce sector. The company. Top Buy Now Pay Later (BNPL) — B2C Payments Companies Klarna specializes in providing payment solutions and services within the e-commerce sector. The company. When you shop in the Klarna app, you can split the cost of your purchase from any online store into 4 smaller, interest-free payments. In select stores. Online offer may vary. Subject to change without notice. No credit needed: *Progressive Leasing obtains information from credit bureaus.

40000 Tax Return

Review and calculate the federal income tax brackets and rates in the U.S and understand how they apply to you from H&R Block's tax experts. Exception: For Wisconsin, a married individual filing as married filing separate cannot claim the earned income tax credit. Only a married individual that. FICA on 40k is ~3k, though doubled if self-employed. Whether your taxable income is $40, a year, $,, or $40 million, the first $10, you earn is taxed the same (10%). The same goes for the next. Certain tax types have a minimum tax liability threshold: Withholding tax returns: Taxpayers whose annual liability exceeds $40,; General Excise and. You can use IRS Form to report details of your capital asset transactions. You should complete this form for each transaction that resulted in a capital. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. The minimum income amount depends on your filing status and age. In , for example, the minimum for Single filing status if under age 65 is $13, If you are single and a wage earner with an annual salary of $40,, your federal income tax liability will be approximately $4, Review and calculate the federal income tax brackets and rates in the U.S and understand how they apply to you from H&R Block's tax experts. Exception: For Wisconsin, a married individual filing as married filing separate cannot claim the earned income tax credit. Only a married individual that. FICA on 40k is ~3k, though doubled if self-employed. Whether your taxable income is $40, a year, $,, or $40 million, the first $10, you earn is taxed the same (10%). The same goes for the next. Certain tax types have a minimum tax liability threshold: Withholding tax returns: Taxpayers whose annual liability exceeds $40,; General Excise and. You can use IRS Form to report details of your capital asset transactions. You should complete this form for each transaction that resulted in a capital. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. The minimum income amount depends on your filing status and age. In , for example, the minimum for Single filing status if under age 65 is $13, If you are single and a wage earner with an annual salary of $40,, your federal income tax liability will be approximately $4,

File taxes online and be sure you receive all of the tax deductions to get the most money on your tax return. woman doing taxes online. ONLINE ONLY PRICING. I live in Ontario and worked a year at a salary of and received $ every month. Does anyone have an idea of what my refund would. Over $40, but not over $60,; $1, plus % of excess over taxpayers upon the filing of your personal income tax return in Use Keeper's tax calculator to see an estimate of your tax bill or refund. Feel free to tinker around, or get serious with our advanced info fields. Your. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year. $, of income) was $2, ($ for three exemptions). If it were not for the $40, of U.S. Savings Bonds, their federal adjusted gross income would. The thresholds for when your benefits will be taxable vary based on your filing status as shown in below the chart. Calculating your Social Security federal. Take another example of someone single with a taxable income for the tax year of $40, You might think your tax would be $4, since $40, falls into. Which of the following applied to your filing status in ?Select all that apply. Have a valid Social Security Number. Have a valid Individual Taxpayer. Extension for Filing Individual Income Tax Return · Individual Estimated Over $40, Up to $60, $2, Over $60, Up to $80, $2, Over. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. If you make $40, a year living in the region of New York, USA, you will be taxed $8, That means that your net pay will be $31, per year, or $2, per. Use this Self-Employment Tax Calculator to estimate your tax bill or refund. This tool uses the latest information from the IRS, including annual changes. $40,, $3,, $2,, $, 16%. $50,, $4,, $3,, $, 14 tax credit every Manitoba resident is entitled to claim on their income tax return. tax rate, and payroll tax deductions, along with an estimate of your tax refunds and taxes owed in File your tax return today. Your maximum refund is. Federal Income Tax Rates. Use the 'Filing Status and Federal Income Tax Rates on Taxable Income' table to assist you in estimating your Federal tax rate. 40, income-eligible taxpayers. The exemption took effect in calendar year beginning with tax returns filed in If you make estimated tax. You can use your results from the formula to help you complete the form and adjust your income tax withholding. Keep in mind that the results will only be as. The IRS determines a standard deduction to reduce each taxpayer's taxable income by a certain amount based on factors like filing status, age and number of. You should file a Mississippi Income Tax Return if any of the following statements apply to you: If John marries Mary, who has taxable income of $40,

1 2 3 4 5 6